Student loan forgiveness

Though student loan forgiveness was considered non-taxable income through the American Rescue Plan passed in 2021 it was only on a federal level. However there is still time for states to make changes to current policies.

Student Loan Forgiveness A Drop In The Bucket

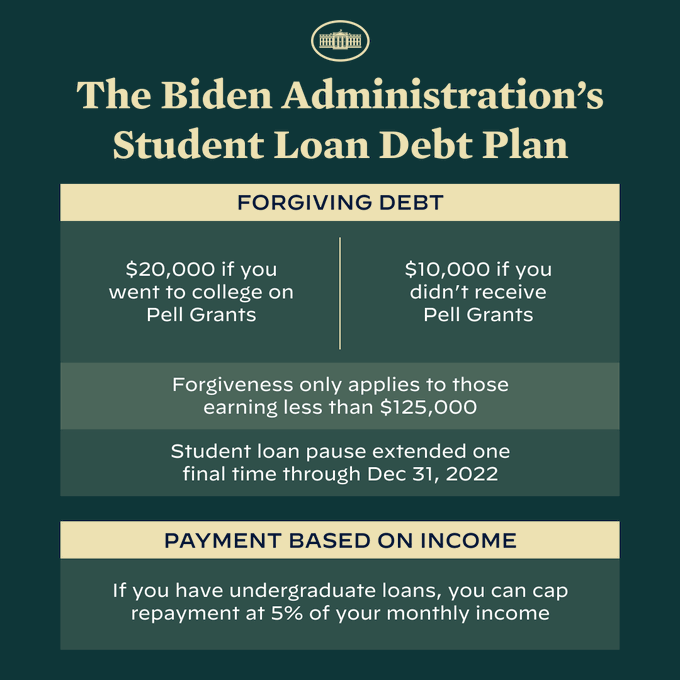

Borrowers can qualify for up to 10000 in student loan forgiveness and recipients of Pell Grants are eligible for an additional 10000 in forgiveness.

. Latest on Student Loan Forgiveness. There are quite a few states that do not conform. Borrowers will qualify for student loan forgiveness under Bidens plan if they made less than 125000 or less than 250000 if they are married in either 2020 or 2021All government-held.

Because of existing laws some states may tax borrowers who receive student loan forgiveness reports CNBC. Student loan forgiveness wont trigger federal taxes but some states may recognize the cancellation as income.

Should I Apply For Student Loan Forgiveness Ramsey

Where Biden S Student Loan Forgiveness Plan Stands Cnn Politics

Application Form For 10 000 Student Loan Forgiveness Now Open Kvue Com

Gn75q J09 33xm

Court Temporarily Blocks Biden S Student Loan Forgiveness

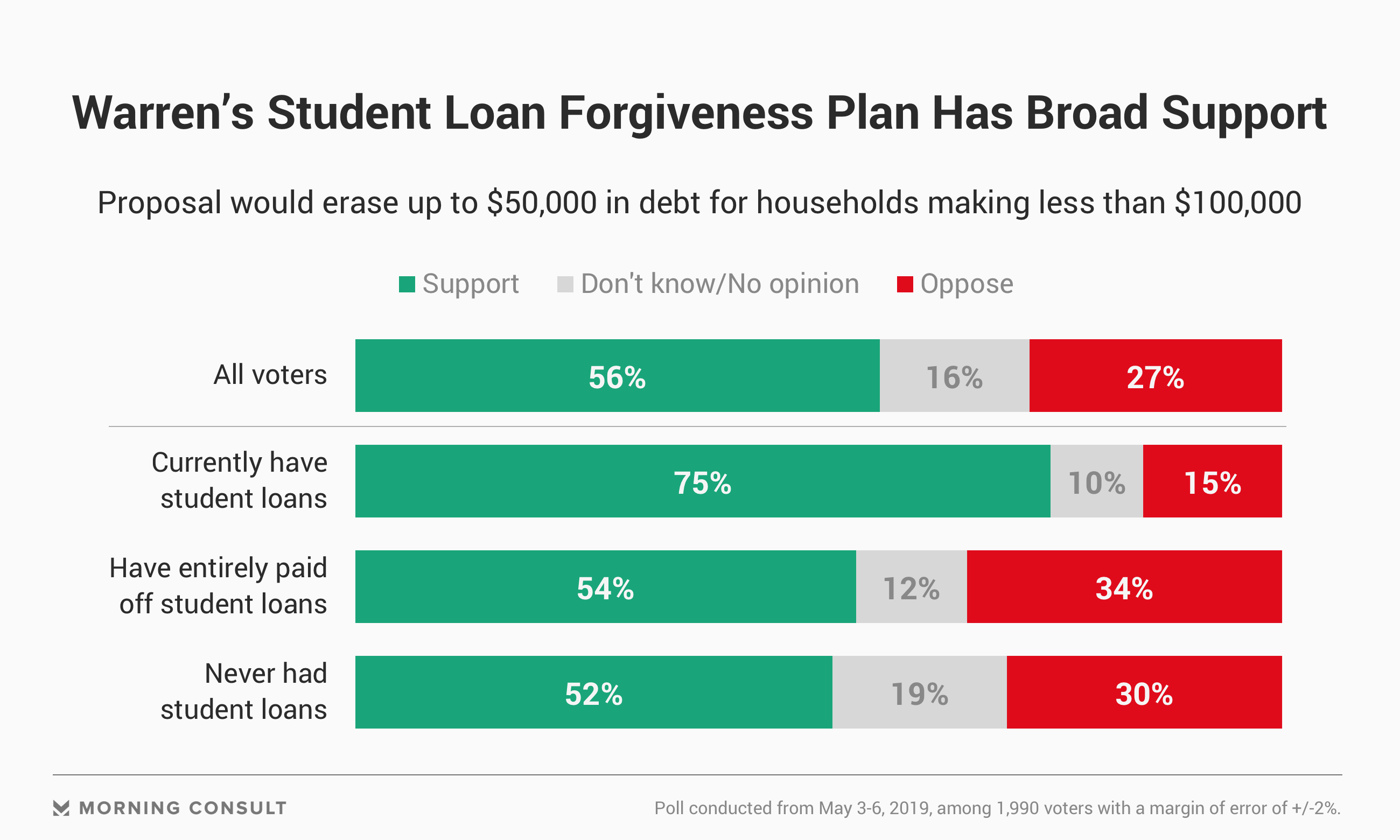

Elizabeth Warren S Student Debt Forgiveness Plan Popular With Voters

President Biden Announces Student Loan Forgiveness Abc News

Student Loan Forgiveness Eligibility How To Apply And More

It S Not Too Late To Apply For Student Loan Debt Relief Here S How To Do It Cnet

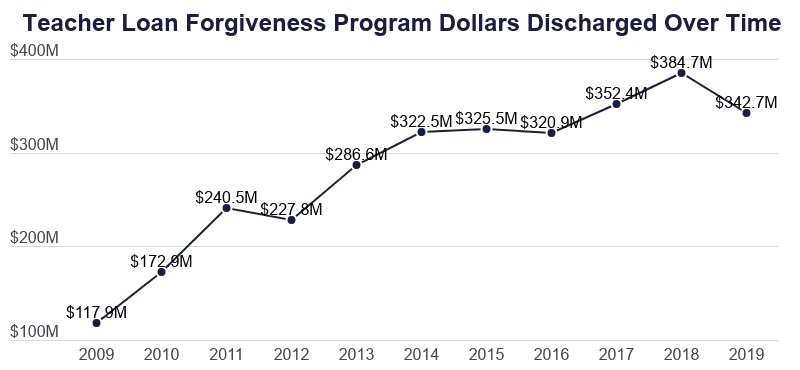

Student Loan Forgiveness Statistics 2022 Pslf Data

Student Loan Forgiveness Statistics 2022 Pslf Data

Conservatives Are In A Legal Battle To Stop Biden S Student Loan Forgiveness Npr

Federal Appeals Court Temporarily Blocks Biden S Student Debt Forgiveness Program Abc News

Q0yihcal41qtfm

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

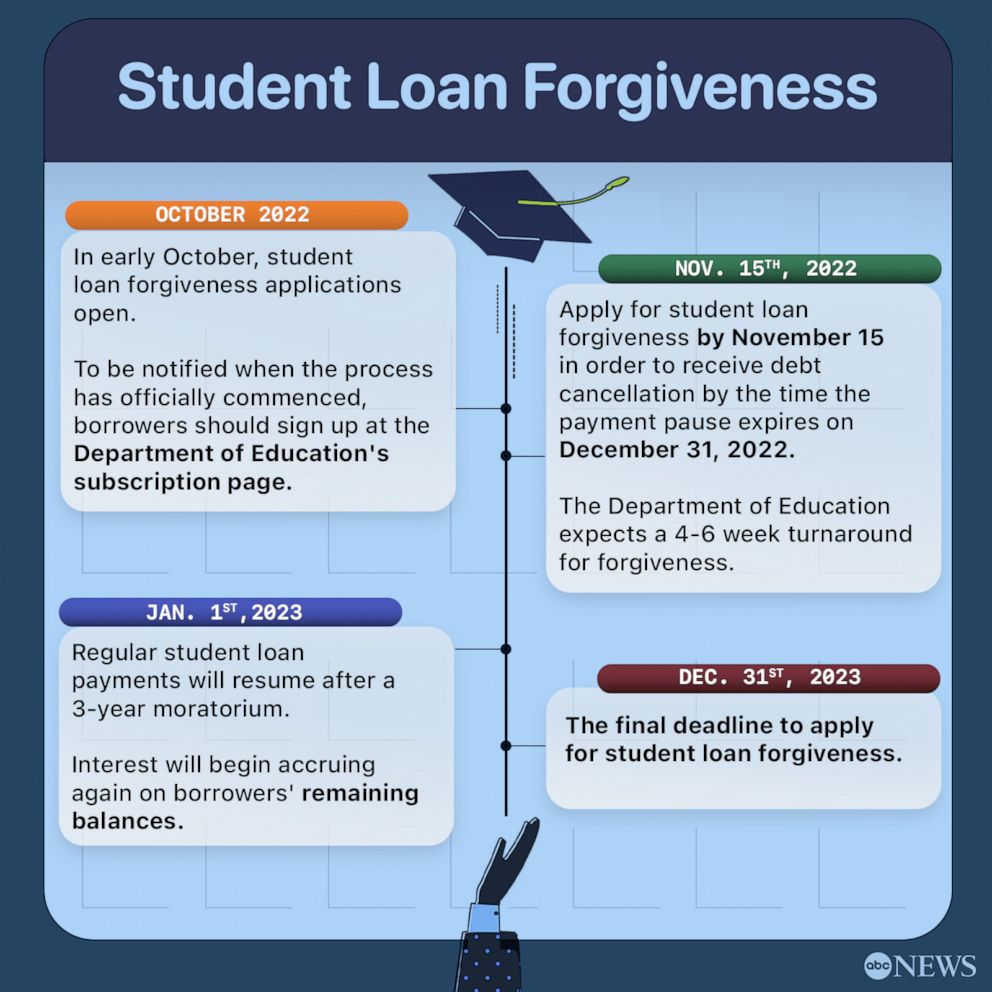

Student Loan Forgiveness Key Dates And Details So Far Abc News

Learn More About Federal Student Loan Forgiveness And Debt Repayment Connecticut Education Association